Data-intensive operations in the finance industry are highly susceptible to threats.The instances of non-compliance are on the unprecedented rise with growing remote work and evolving workplaces. To avoid incrementing regulatory breaches and unrecoverable data loss, which could also invite hefty penalties – finance businesses are facing the high time to adopt effective security measures that can help counter risks, regulate processes, and control non-compliance incurred costs. Let’s further discuss.

Table of Contents

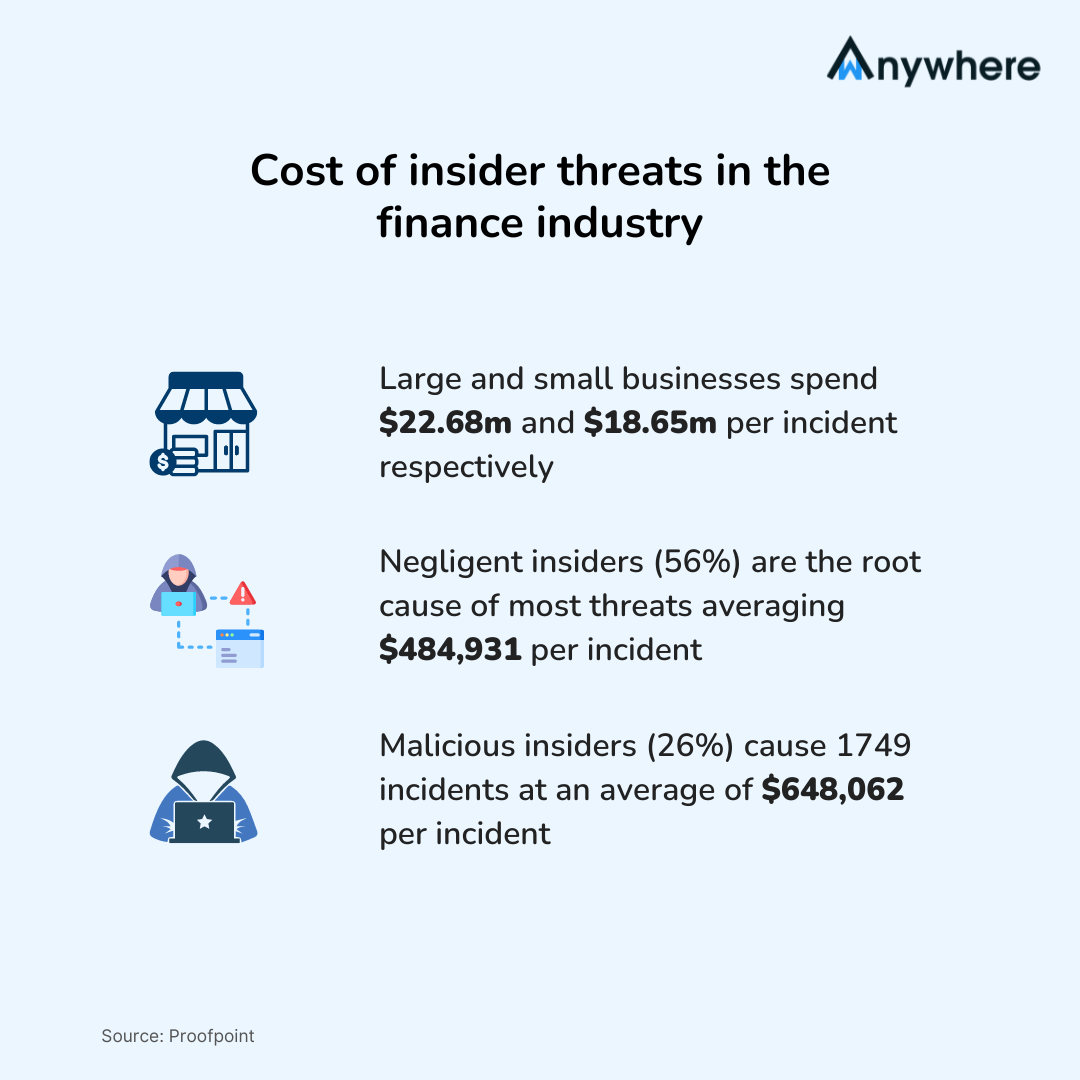

The data-critical environment in finance companies demands high regulation to manage compliance for teams processing sensitive information. Even the slightest ignorance can act against defined security standards and incur compliance costs. A report states employee negligence causes 55% of insider threats and costs $6.6m to businesses. If left ignored, insider risks could grow into insider threats causing data and reputation damage that financial firms can avoid by integrating an effective security system into their workflows. With advanced AI capabilities for behavioral and predictive analytics, wAnywhere – a future work platform innovated by ShepHertz – provides robust security and compliance solutions to control insider threats for enterprise risk management.

Let’s start with understanding what are insider threats and what is the need for insider threat prevention:

What are insider threats

Insider threats are authorized roles working on critical business positions and involved in business data breaches intentionally or unintentionally. Intentional insider threats are motivated by money and other benefits to disclose business data to unauthorized persons or third parties. While unintentional insider threats lack proper training to follow business policies and compliance that often leads to violations. No matter what the threat is, you need to avoid impact on your business operations.

Why is need for insider threat control

In data-driven industries like Finance, where workplace compliance is important, aligning employee behavior with business rules is a challenge. Falling short on ensuring regulation is no option in data-sensitive environments as it can cause unrecoverable customer and business information violations, impacting the trust of organizations. Moreover, it could attract sizeable regulatory fines and disrupt business continuity. The incurring non-compliance cost can be too much to bear for financial sector companies, and now – when growing workplace digitization also adds to the regulatory complexities – it is high time to find a robust way for efficient and safe business operations.

What role wAnywhere security and compliance can play

With advanced AI potential for real-time and automated violation detection, wAnywhere employee monitoring software has the confidence of leading compliance standards, including ISO, HIPAA, GDPR, SOC 2 Type 2, and the trust of finance service clientele to enable data-critical businesses like yours to ensure compliance and regulate operations.

Let’s further discuss how you can implement enterprise security compliance for your financial service business with AI-enabled data privacy and security solutions powered by the wAnywhere employee tracking tool:

AI-enabled face recognition to negate invalid access

Avoid unauthorized access to business data with AI-powered highly precise face recognition and authorize only validated persons at work for information confidentiality.

Live screen recording to detect risky actions

Predict and prevent risky activities with live screen monitoring that enables behavior analytics and anomaly detection to control suspicious actions indicative of threats.

Clean desk policy for workplace compliance

Ensure a clean desk policy to align the financial work environment by identifying employees not at the desk, unknown or multiple persons around the work desk, and mobile detection at work to counter any malicious effort of screen recording or data capture.

Keystroke detection to prevent screen capture

Eliminate any dubious activity of capturing screens showing sensitive information with keystroke detection and prevent Ctrl C + Ctrl V action on the keyboard to negate data privacy risks.

Data masking for confidentiality

Capture real-time screenshots for visibility into how teams handle confidential data and align the workforce with the security standard of data masking for PII/PHI information confidentiality.

Compliance governance to regulate operations

Create and enable rules to boost compliance governance in your financial workplace and help teams align with regulations for safe business operations.

What advantages you can gain with wAnywhere security

wAnywhere offers robust security and compliance solutions for companies in the finance industry, solving the most complex issues they experience today from non-compliance at work to data compromise, and behavioral risks to workplace security.

Let’s discover how you can strengthen workplace security and align business operations for your finance company with AI-powered robust monitoring from wAnywhere:

Predict risks before they cause damage

What if you can identify and eliminate risks before they cause harm? Gain the AI-driven advanced capability to prevent risks from gaining access to critical information with highly precise face recognition from wAnywhere and control threats by placing a robust security check at the entry point of the business process.

Respond in real-time to control threat incidents

Responding in real-time against suspicious actors enhances your potential to eliminate risks in your financial business. Get help with Live Screen Recording from wAnywhere to act at the right moment against suspicious activities by predicting and eliminating them as they occur.

Enhance workplace security posture

Integrate security at highly risky finance service points and negate risks to strengthen security posture at your workplace. Get real-time predictive analytics with AI-driven multi-factor automated violation detection and enable comprehensive security for your finance business. Understand the risk actors in your financial sector company with actionable security and compliance analytics utilizing the wAnywhere monitoring tool. Gain the capability to respond in real-time and act ahead of threats in your finance service workplace. Start your wAnywhere experience today and benefit from compliance governance for more aligned teams.

Are insider threats complex to detect? Why is workplace compliance important?

Internal risks can benefit from the organization’s trust and stay unidentified while using their authorized access to violate data confidentiality. Compliance monitoring enabled by AI-based automated detections from wAnywhere can help implement and measure security policies for your finance company to strengthen regulatory governance and curb internal threats.

Why is live screen recording effective against insider threat prevention?

The live screen recording feature from wAnywhere helps you gain advanced capabilities to predict and prevent malicious insider activities and ensure no impact on data privacy or business reputation.

wAnywhere Blog

Check out the wAnywhere blog to learn more about our product, customer stories, and our take on meetings, remote working, productivity, and more.