Growing threats have caused a grave security concern for organizations where data is at the center of business operations, including the Banking, Financial Services, Insurance industries (BFSI), and BPOs. The rising threat landscape indicates an urgent need to adopt strong countermeasures for threat mitigation and operational efficiency.

Table of Contents

The high liability of BFSIs and BPOs towards regulatory compliance gets disrupted by increasing data attacks, inviting hefty fines and loss of business credibility. Rising security threats indicate an urgent need for Fintech and Call Centers to adopt a robust threat intelligence system that can help control risks and ensure workplace regulations.

Let’s start with understanding what causes the most threats to the Fintech and Call Centers and the potential impact of security breaches on their business operations.

What causes the most threat to Fintech and Call Centers

Data-intensive operations in both industries receive the most threats from insiders with ill intentions, followed by regulatory compliance breaches and unvalidated financial data privacy exposure.

Insiders with malicious intent

Employees with malicious intent cause the most damage by misusing their authority and exposing vital data to competitors or third parties, harming business trust and reputation.

Workplace non-compliance

Threat actors exploiting security vulnerabilities in organizations make their way to critical business resources to leak the information, inviting hefty regulatory fines and loss of revenue.

Unauthorized data disclosure

Increasing data attacks disclose sensitive client or business details to unauthorized parties who can gain access to vital resources and get competitive benefits, damaging the trust and reputation of the concerned organizations.

The after-effects of data attacks can be severe if threat actors are not detected and prevented in the early stages. Organizations with data-critical operations, including BFSIs and BPOs, need to develop strong resilience capabilities against incrementing threats to gain firm control over them and avoid risks to data privacy.

Let’s understand how data threats can disrupt workplace compliance and clients’ trust in Fintech and Call Centers.

What is the Impact of data threats on Fintech and Call Centers

Rising data threat incidents can gravely affect the business credibility of organizations and disrupt clients’ faith in continuing the partnership.

Breach of regulatory compliance

Threat actors infiltrating security rules to gain access to vital business resources can disrupt organizational obligations towards industry regulations to maintain data security.

Hefty fines and loss of revenue

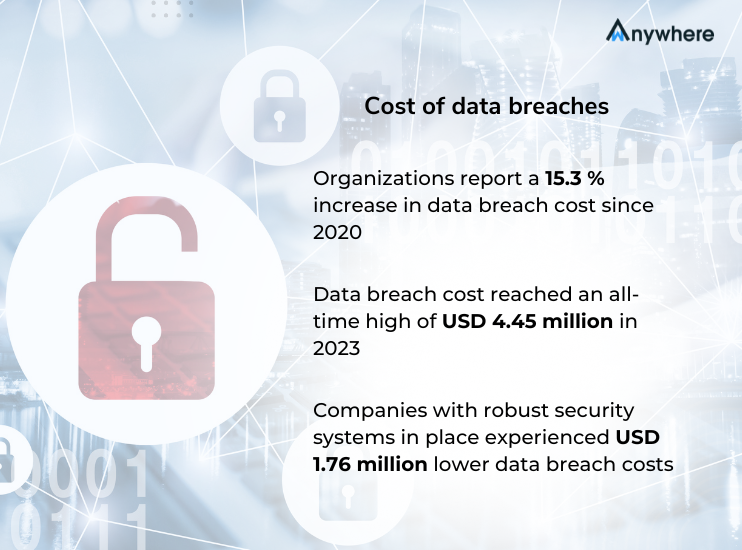

The occurrence of data breach instances leaves organizations suffering greater revenue losses against regulatory charges and with loss of credibility – that they need to rebuild investing significant efforts and time to regain the lost ground.

Damaged business trust and reputation

Insider data theft instances affect the business progress of organizations and impact their ability to reclaim growth.

Leverage wAnywhere as fintech and call center compliance monitoring software, trusted by leading BFSIs and BPOs worldwide who achieved significant threat mitigation and over 95% operational efficiency using AI-powered security.

How wAnywhere AI-enabled security can help mitigate threats

Gain AI-powered advanced security and compliance capabilities of wAnywhere for real-time threat detection and achieve firm control over incrementing data theft incidents.

Real-time actionable analytics

Keep track of what activities employees do at work and what their activities deviate from workplace regulations, posing risks of breach to financial services and call center compliance.

Risk prediction and prevention

With continuous monitoring, you can identify what employee activities indicate risks and how they can impact your organization’s liability toward regulatory compliance. Leverage actionable insights to respond ahead of threats and prevent potential damage to data confidentiality, and business trust.

Measure and manage workplace compliance

Enable risk-preventive security rules including Clean Desk policy and industry regulations to mitigate distractions, improve focus at work, and align employee behavior with business goals.

Ensure data privacy and operational efficiency

Stay in sync with how employees behave at work and control their actions to eliminate risks and regulate operations. Unlock AI-driven real-time threat intelligence from employee monitoring software – Start your wAnywhere experience today with a 14-day free trial to find out how you can prevent risks before they cause damage and drive operational efficiency by +95%.

wAnywhere Blog

Check out the wAnywhere blog to learn more about our product, customer stories, and our take on meetings, remote working, productivity, and more.